monterey county property tax rate

Supplemental assessments were established pursuant to provisions in Senate Bill 813 known as the Hughes-Hart Educational Reform Act of 1983 enacted on July 29 1983 and Article XIII A Proposition 13 of the California Constitution passed by the voters on June 6 1978. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate.

Monterey County collects on average 051 of a propertys.

. In association with this function the Division also provides property-assessment related information to the public. Information in all areas for Property Taxes. Free Case Review Begin Online.

Get free info about property tax appraised values tax exemptions and more. See Property Records Tax Titles Owner Info More. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services.

168 West Alisal Street. Find All The Record Information You Need Here. Compared to the state average of.

For comparison the median home value in Monterey. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities. Based On Circumstances You May Already Qualify For Tax Relief.

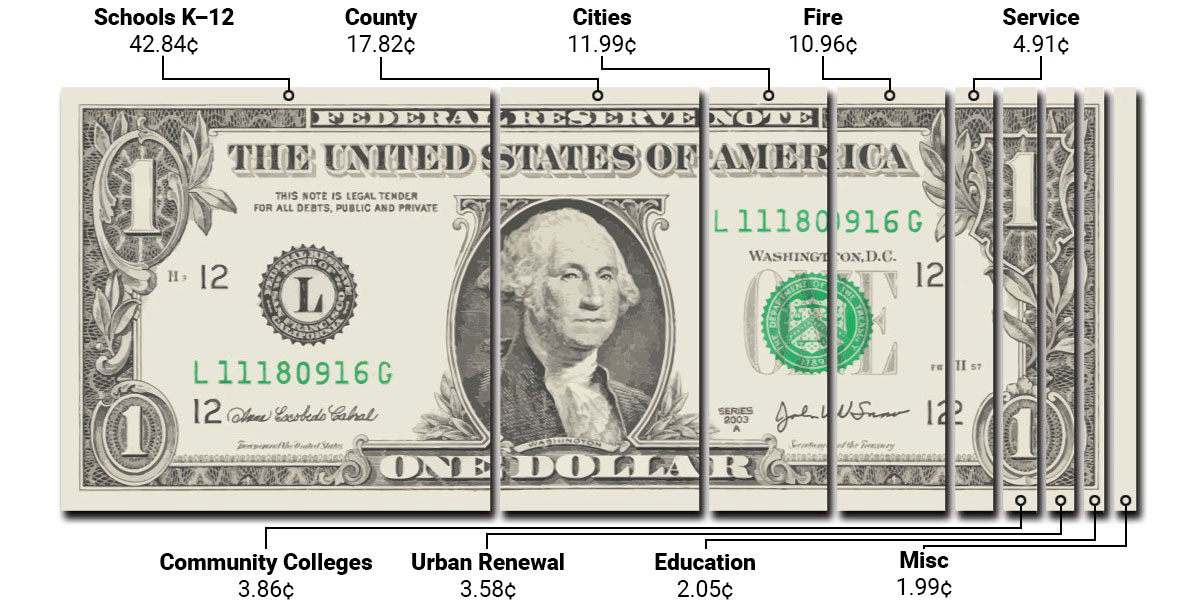

The Real Property Division is responsible for valuing real property for property taxation purposes and enrolling the values of all taxable real property including land and physical improvements on the tax rolls. Calculation of Taxes Page 5 Property Tax Highlights FY 2020-21 Once the Assessor has finalized the assessment roll it is provided to the Auditor-Controller on or before July 1st. Monterey County is located in California which means it has the federal law of.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025. Ad Unsure Of The Value Of Your Property. Salinas California 93902.

Then who pays property taxes at closing when buying a house in Monterey County. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas. Monterey County Property Tax Rate How are Monterey County property taxes calculated.

The Monterey County Assessment Roll may be searched by clicking on the Property Value Notice link above. Tax Rate Areas Monterey County 2022. Real estate ownership shifts from.

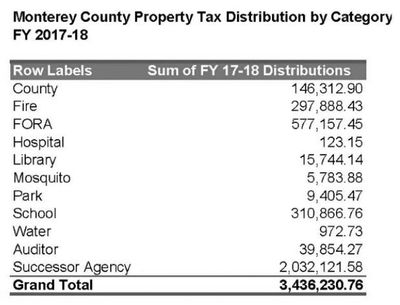

Monterey county collects relatively high property taxes and is ranked in the top half of all counties in the united states by property. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector.

Search Any Address 2. As computed a composite tax rate. Overview of Monterey County CA Property Taxes.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. You will need your 12-digit ASMT number found on your tax bill to make payments. You may search by Fee Parcel number and Assessment.

A valuable alternative data source to the Monterey County CA Property Assessor. Get In-Depth Property Tax Data In Minutes. Choose Option 3 to pay taxes.

Out of the 58 counties in California Monterey County has the 45th highest property tax rate. Start Your Homeowner Search Today. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

Note that 1095 is an effective tax rate. Ad See If You Qualify For IRS Fresh Start Program. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established.

Normally whole-year property taxes are paid upfront a year in advance. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Seventeenth Century French Warship Art Print Morel Fatio Art Com

California Measure Could Spur More Seniors To Sell Homes Easing The State S Housing Crunch House Cost Mortgage Rates Mortgage

Watching These Kids Grow Here Is Our New Stomping Ground At Franich Park In Watsonville South California Real Estate Watsonville California Homes

Property Tax California H R Block

Assessment And Taxation Clackamas County

8377 State Road 259 Lost River Wv 26810 Mls Wvhd105262 Zillow Lost River Zillow Home Inspector

Additional Property Tax Info Monterey County Ca

How To Calculate Your Tax Bill

The California Transfer Tax Who Pays What In Monterey County